Hey there, fellow seekers of financial independence! Today, I’m excited to dive into a topic that’s close to all of our hearts: mastering the art of wealth. In this comprehensive guide, I’ll be sharing practical insights, actionable steps, and invaluable tips that will set you on the path towards achieving financial freedom. So, let’s embark on this journey together and pave the way towards a more secure and abundant future.

Table of Contents

Mindset Matters: Building a Wealthy Mind

Before we delve into the nitty-gritty of financial strategies, let’s start with the foundation: your mindset. Developing a wealthy mindset is the first step towards achieving financial independence. Cultivate a positive attitude towards money, embrace a growth-oriented outlook, and believe in your ability to create and manage wealth.

Set Clear Financial Goals

Picture this: you’re planning a road trip without a destination in mind. Sounds counterproductive, right? The same goes for your financial journey. Set clear and achievable goals that resonate with your aspirations. Whether it’s owning a home, paying off debt, or retiring early, having well-defined objectives will give you direction and motivation.

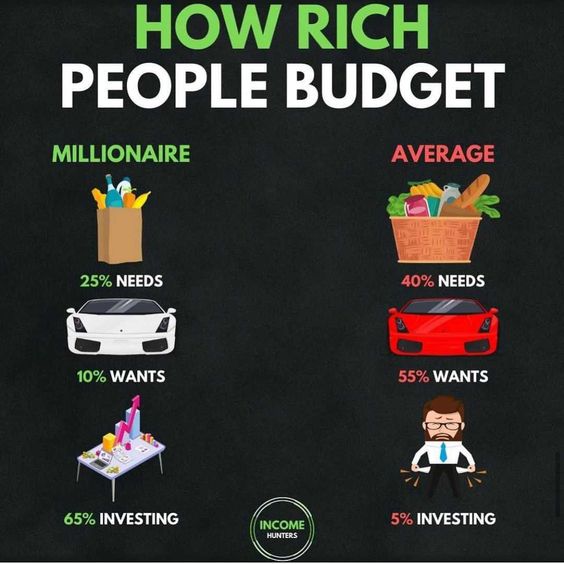

Create a Budget that Empowers You

A budget isn’t about restricting yourself; it’s about taking control of your finances. Observe your earnings, outgoing costs, and financial objectives. Allocate your funds wisely to cover essential expenses while still allowing room for enjoyment and investments.

Debt Management: Taming the Debt Monster

Debt can be a stumbling block on your journey to financial independence. Take a proactive approach to manage and eliminate debt. Prioritize high-interest debts, consolidate if necessary, and avoid accumulating unnecessary debt in the future.

The Power of Saving and Investing

Saving money is essential, but it’s investing that truly accelerates your journey to wealth. Diversify your investment portfolio to manage risk and capitalize on various opportunities. Learn about stocks, bonds, real estate, and other investment vehicles to make informed decisions.

Smart Spending Habits

Being financially savvy doesn’t mean depriving yourself. It’s about making conscious spending choices. Differentiate between needs and wants, hunt for bargains, and consider delaying gratification for bigger rewards down the road.

Multiple Income Streams

In today’s dynamic world, relying solely on one income source might not be enough. Explore side gigs, freelancing, or starting a small business to supplement your primary income. Creating multiple income streams not only increases your earning potential but also enhances your financial security.

Tax Efficiency Strategies

Minimizing your tax liability is a crucial aspect of wealth management. Familiarize yourself with tax-efficient investment strategies, deductions, and credits that can help you keep more of your hard-earned money.

The Magic of Compounding

Albert Einstein once said, “Compound interest is the eighth wonder of the world.” Embrace the power of compounding by investing early and consistently. The longer your money grows, the more it can work for you.

Retirement Planning: Securing Your Future

Planning for retirement isn’t something you should postpone. Start early, contribute consistently to retirement accounts, and consider consulting with a financial advisor to ensure you’re on track for a comfortable retirement.

Continuous Learning and Adaptation

The world of finance is constantly evolving. Keep abreast with market developments, laws, and investment opportunities.

Attend seminars, read books, follow financial experts, and adapt your strategies accordingly.

Giving Back and Paying It Forward

As you climb the ladder of financial success, remember to give back to your community and those in need. Generosity not only enriches the lives of others but also enhances your own sense of purpose and fulfillment.

Conclusion

Congratulations! You’ve reached the end of our ultimate guide to financial independence. Remember, this journey is yours, and each step you take brings you closer to your goals. Embrace the lessons learned along the way, and never underestimate the power of persistence and discipline. With the right mindset, knowledge, and actions, you have the tools to master the art of wealth and achieve the financial independence you deserve. Here’s to your prosperous future!